Can BTR Suburban Communities Deliver on the Levelling up Agenda

With Michael Gove returning as Secretary of State at the Department for Levelling Up, Housing and Communities, it’s (reasonably) safe to assume that the levelling up agenda will be resumed. But how will its roll-out be impacted by recent events, and how will that affect the BTR market?

Changing political and economic factors

The situation has changed significantly since Gove left office in July. In brief, mortgages are up, house prices are down and the cost of living is becoming a greater concern all round.

In some respects these factors, which are undoubtedly impacting on Build to Sale (BTS), can work to the advantage of BTL. The main beneficiary will be ‘BTR suburban communities’ – the term that LRG uses to describe large-scale mixed-use communities which comprise mostly of homes for rent. Investors are attracted to this as a form of investment because of the variety of property types (residential, commercial, retail and leisure) which exist within any one portfolio, creating immediate sales revenue and long-term rental revenue, with the potential to spread the investment according to the market conditions. Developers, too, welcome the opportunity to spread risk and of course attractive rental properties with secure leases and the opportunity to upsize at little cost, increasingly appeal to families.

But despite its potential, the provision of BTR suburban communities is currently failing to meet demand. According to Rightmove, the number of tenants in the UK increased by 6% in 2022, coinciding with 50% fewer properties being available. The cost in rents is inevitable. We have seen similar figures across our Leaders and Romans offices and almost total lack of voids speaks volumes about demand. Furthermore with the rising costs of mortgages and a slow down in new homes sales rates (or maybe just say ‘prevailing trends in the property market’ as I don’t want to be too negative!), I predict that suburban B2R operators will become more competitive in the immediate land market.

Consequently, securing land deals for BTR suburban communities is an increasingly important part of my work as a land director and our team is working across the UK to identify sites suited to this form of tenure.

This ties in neatly to the political agenda for ‘levelling up’ as, with a range of house types, strong emphasis on community, provision of local services and the employment opportunities that this brings, BTR suburban communities have considerable potential to instigate regeneration. As far as levelling up is concerned, BTR is undoubtedly part of the solution.

Regional focus

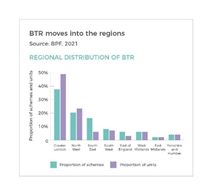

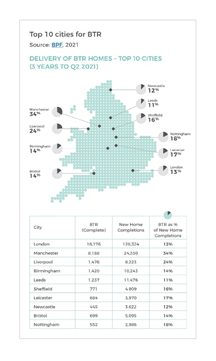

Initially London accounted for the majority of the BTR pipeline. Recently, however, the momentum has swung towards the regions: BPF research shows that over the course of 2021 construction commenced on 13,527 units across regional cities, over three times the total number in London.

Until recently, again according to the BPF, growth outside London has largely been confined to cities (Manchester, Liverpool and Birmingham being the most popular), and the BTR schemes not located in urban centres tended to be situated close to transport infrastructure, facilitating convenient access to city centres.

However, as young families increasingly look to rent, rather than buy, the demand for BTR suburban communities outside the major cities is increasing.

Government support but a lack of policy

The case for BTR recently received a boost when the Government gave a clear indication of its support in the form of a Renters Reform Bill.

But not only is a draft Bill still awaited, but a policy vacuum still exists: when it was created in 2012, the then 55-page National Planning Policy Framework (NPPF) replaced hundreds of pages of very specific planning and development policies. Much of this policy was intended to be implemented through Local Plans, but few local authorities have yet incorporated BTR in planning policy, and with the ‘streamlining’ of Local Plans proposed by the Levelling Up and Regeneration Bill, their capacity to do so is limited. Yet there are aspects of BTR development, such as houses sizes, parking and the provision of district heating systems which, because they apply differently in BTR and Build to Sell (BTS) communities, would benefit from more specific polices.

The Bill has also promised a new suite of National Development Management Policies

to exist alongside the NPPF, to which all Local Plans must refer. This has potential to fill the policy vacuum and allow BTR suburban communities to compete evenly with more established development typologies.

Planning ahead

Another feature of the successful roll-out of BTR schemes is operators’ early involvement. Development decisions including sizes of gardens, unit size, housing mix, parking provision, inclusion of a concierge and shared amenities should be taken in conjunction with those who will manage the scheme: the best examples of such schemes are not only built to rent, but planned for rent too.

But currently the land-buying and development industry is weighed against BTR operators due to a lack of data to enable informed decision-making.

Conclusion

Levelling Up and Regeneration Bill is the key piece of legislation impacting BTR development as well as, potentially, the solution to the housing crisis. Therefore the opportunity for BTR, as a relatively nascent sector, is to lobby for its interests to be represented within the emerging policies and in doing so, to assist in addressing immediate need.

Furthermore, BTR conforms with the Levelling Up White Paper’s more specific goals of addressing current weaknesses in the private rented sector – specifically in providing a better quality of rental product that is professionally managed and ultimately allows for more affordable rents.

There is inevitably a geographical dimension to the provision of suburban BTR. In areas where property values are high, it can become unviable to provide the necessary services: additional services become less feasible where typical sales values exceed £500 per sq ft and at that level, the BTS market dominates. In the least expensive areas, the 30% premium may be unaffordable for the majority of the residents. In reality, the £300-400 per sq ft price bracket is most likely to be compatible with the BTR model, and this is most frequently found in the home counties, midlands and south west.

The reality is that market forces are not naturally inclined towards levelling up, with development decisions favouring popular, tried and tested locations over those most in need of regeneration.

Altering this status quo is impossible without the changes I have described. But the evolution of BTR is outpacing policy. For the full potential of BTR to be realised in the context of levelling up, emerging legislation must adapt to, and reflect this considerable change in demand.

Contact Us

Got a question, general enquiry or something else?

You may also like

Since we started in 1987 we have grown to one of the UK’s largest property groups, we can save you time and money by offering a range of services and expertise under one roof.