Potential for BTR to help de-risk schemes

Recent political and economic uncertainty has inevitably caused some fluctuations in housebuilders’ profit forecasts: following the Truss Government’s disastrous mini-budget, analysts including Credit Suisse and Capital Economics predicted house price drops of as much as 15 per cent and volume builders including Barratt Developments and Bellway were reported to have abandoned growth plans for this year.

Whether the economy bounces back under a new Prime Minister (or Government?), housebuilders will invariably reviewing their strategic direction in light of recent changes.

And as many are already finding, those factors which dented confidence in the private sale market are having the reverse impact in the private rented market (PRS): higher mortgage rates, the potential of a housing slump and financial instability are likely to fuel the demand for rental properties and continue to fuel further rent increases for the foreseeable future; good for investors perhaps, not so for the consumers who already face cost of living rises across the board. The smart investor should look to provide alternative incentives to attract solid long term residents to their product.

Despite this potential, the PRS is failing to meet demand following the withdrawal of thousands of amateur landlords from the market (since Q1 2017, there have been more than 180,000 buy-to-let mortgage redemptions). According to Rightmove, the number of tenants in the UK increased by 6% in 2022, coinciding with 50% fewer properties being available, and we have seen similar figures across our Leaders and Romans offices.

A natural change in direction, therefore, is for property developers to capitalise upon the significantly buoyant rental market. With, according to the English Housing Survey in 2022, the number of households renting privately having increased by 93% in the last 15 years (while the number of owner-occupied households grew by just 3%) there are incalculable advantages in doing so.

Firstly, Build to Rent (BTR) is very different product and investment opportunity to that of the traditionally perceived rental model: BTR epitomises the Government’s desire to ‘professionalise’ the private rented sector in providing a secure home and a high standard of both bricks and mortar and service.

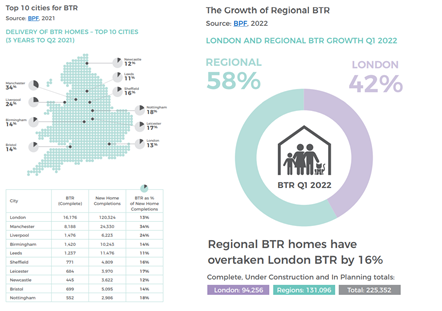

The regional growth of the PRS is another: BTR is no longer limited to the major cities. Until recently, the vast majority of BTR schemes have been in London, but regional growth has now surpassed growth in the Capital. The BPF’s Build to Rent Q1 2022 analysis found that whereas 5,802 completed BTR homes were in London, 5,901 were in the regions. Regional BTR grew 16% year-on-year, to reach 58% of the total BTR sector pipeline; London, meanwhile, lags behind slightly with 12% year-on-year sector growth and 42% of the total pipeline.

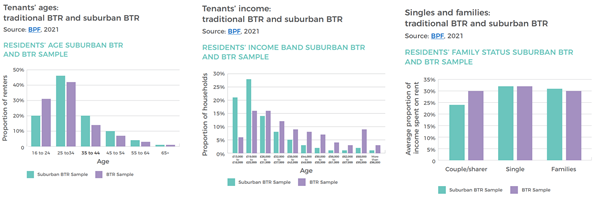

Another reason is the increase in families choosing to rent, rather than buy, is another. According to Government figures, the number of renting households with dependent children has doubled since 2003/4, and now makes up 30% of the sector. The same survey shows that the numbers of ‘comfortable renters’ (those in managerial professions, who hold degrees and are in good health) are expanding too, with this demographic representing 1.94 million households (44% of the PRS). Furthermore, a substantial proportion of ‘comfortable renters’ expect to remain within rented properties long term.

It is this shift in the demographic profile of renters and the significantly increased numbers choosing to rent that has turbo-charged the BTR sector. The British Property Federation (BPF)’s Build to Rent Q1 2022 report reveals that the number of completed BTR homes rose by 19% during 2021. Furthermore analysis just released shows that the sector had reached a new high of 76,800 completed units per annum and is projected to rise to more than 380,000 with a decade.

As the inevitable conclusion of each of these factors, a new model has evolved: the BTR suburban community. Providing desirable homes for families in fully-functioning serviced communities, this product - which offers growing families considerable flexibility and a wide range of options for a hassle-free lifestyle - is undoubtedly the sector in which we will see the greatest growth over the next decade.

The potential for expansion of this sector is almost unlimited, as counter-urbanising maturing Millennials seek family homes in bespoke communities. Those who have previously experienced the high level of service provided by traditional BTR are thought likely to form the core market for BTR suburban communities. This innovative, service-based product compares favourably with most of the PRS stock currently available, and the popularity of the product will enable BTR suburban communities to attract additional investment and grow at pace.

For developers, there are other distinct advantages in creating BTR suburban communities in an uncertain economic climate. One is that the variety of property types (residential, commercial, retail and leisure) which exist within any one community provides the opportunity for both immediate sales revenue and long-term rental revenue, with the potential to alter the make-up of a scheme according to the market conditions. There is considerable potential for amalgamation with other property classes including the later living and affordable housing sectors, joint ventures leading to innovative cross-subsidies, and public/private partnerships provide further opportunities.

Furthermore, the BTR suburban communities model in the UK undoubtedly has some catching up to do with other markets: in Europe a high proportion families rent (as many as 60%, for example, in Switzerland ) and in the US the predominant form of BTR, accounting for 70% of the market, is larger, family-oriented homes, within low-rise, suburban developments.

Recent research among global institutional investors found that 70% anticipated being active in the BTR suburban communities market within the next five years: a substantial increase from the 42% currently active. The same survey found that institutional investors planned to invest a record £16.5bn in residential assets in 2022: a 65% increase from the £10.2bn spent in 2021. With John Lewis and others leading the way with significant success, the opportunities for developers are considerable and have the potential to counter a slump in the sales market.

Contact Us

Got a question, general enquiry or something else?

You may also like

Since we started in 1987 we have grown to one of the UK’s largest property groups, we can save you time and money by offering a range of services and expertise under one roof.